Uncategorized

Uncategorized

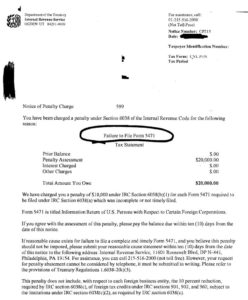

2017 Payroll and 1099 Reporting due January 31-Message from…

Attention businesses: Don’t forget your deadline for filing your Forms 1099 and Payroll reports is January 31, 2018. If you made payments to service providers or other mandated reporting persons, attorney’s, etc. please be certain that you have a signed Form W-9 on file for them now so that this information can be reported on the Form 1099. Lack of a reporting number will cause rejection and possible penalties and deny your deduction for the expenses.

Here is an email that I just received from NYS reminding payroll reporting:

Important Annual Payroll Tax Filing Reminder

The due date is January 31, 2018.

File your annual wage and withholding information (including other payments, such as pensions) timely and accurately.

If you use a payroll service or other preparer, give your annual wage and withholding information to them promptly and accurately. Before the due date, verify that they filed all required information on time.

You may face a penalty if you do not:

- provide your employee’s annual wage and withholding information, or

- file on time.

Filing methods

Visit our website and choose the filing method that works best for you.

Avoid common errors

Take measures to limit processing delays by avoiding common errors.

Respond quickly if contacted

If your annual wage and withholding information is not filed or contains errors, we may contact you. You must respond immediately with the required information.

Questions?

- Visit our website at www.tax.ny.gov (search: TR-150.5)

The Tax Department will never send you an email asking you to validate personal information such as your username, password, or account numbers